Note: This article does not necessarily reflect the opinion of KEC Ventures, or of other members of the KEC Ventures team.

Supplying the world with nearly everything is an enormous and complex job: there are things to discuss.

– Rose George (2013-08-13). Ninety Percent of Everything: Inside Shipping, the Invisible Industry That Puts Clothes on Your Back, Gas in Your Car, and Food on Your Plate (p. 142). Henry Holt and Co.. Kindle Edition.

Our blog post about startups building software products for the shipping industry generated more interest than I anticipated. Unfortunately, some readers got the impression that we intended to focus more on containerships than on the bulk shipping segment of the industry. That was not our intention, and so I promised I’d spend more time digging into the bulk carrier portion of the market when I published an update.

This blog post will not make any sense if you have not already read Industry Study: Ocean Freight Shipping (#Startups) – which I co-authored with John Azubuike. Also, reading this post or the preceding one will be a waste of time if you do not have a strong interest in shipping, AND in early-stage technology startups building products for the shipping industry.

KEC Ventures is an institutional seed-stage venture capital fund based in New York. We invest between $500,000 and $1,000,000 in seed-stage startups building software products. We have been doing this since 2011. ((For logistical reasons, we are currently focused on investing in startups based in the United States and Canada.))

Together with our new teammate Dylan Reid, John and I have a strong interest in supply chain and logistics startups. We think of shipping and trucking as essential components of that landscape, and so we seek founders building startups in that market. We are also eager to connect with industry insiders with whom we can start building a relationship and hopefully collaborate in the future.

You can reach us at;

- brian@kecventures.com (@brianlaungaoaeh), or

- johna@kecventures.com (@jnazubuike).

With those preambles out of the way; on with the show.

What is the relative size of the Bulk Shipping market?

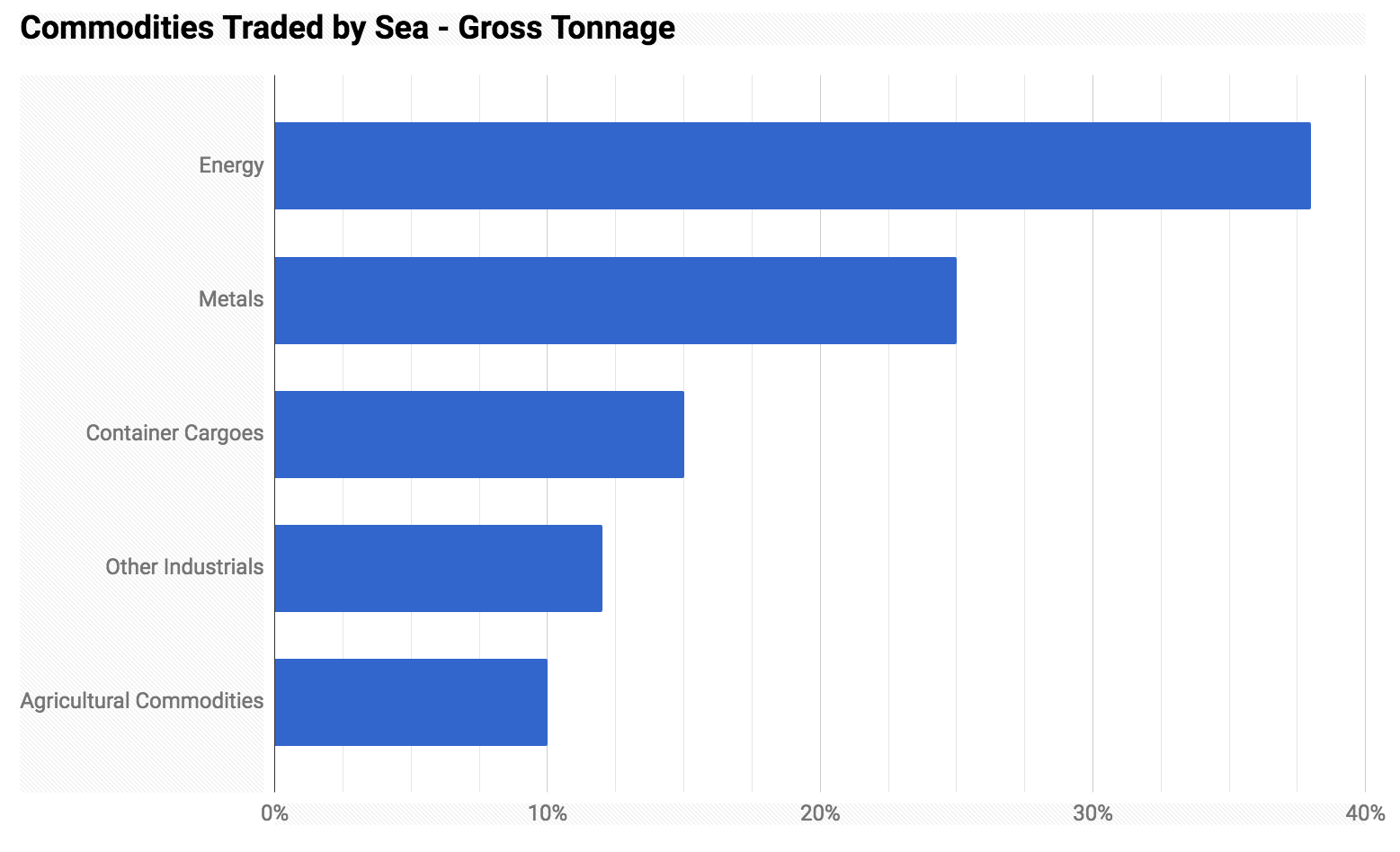

The following chart shows the distribution of commodities traded by sea. It is based on data from The Tramp Shipping Market, a March 2015 update to an earlier report for the European Community Shipowner’s Association prepared by Clarkson Research Services. It is pretty self explanatory; By gross tonnage energy is 38%, metals is 25%, container cargoes 15%, other industrials 12%, and agricultural goods account for 10% of all goods traded by sea. ((Tramp shipping is a combination of the traditional bulk shipping segment with the specialist shipping segment of the market. So in this case one could argue that bulk shipping accounts for 85% of the market.))

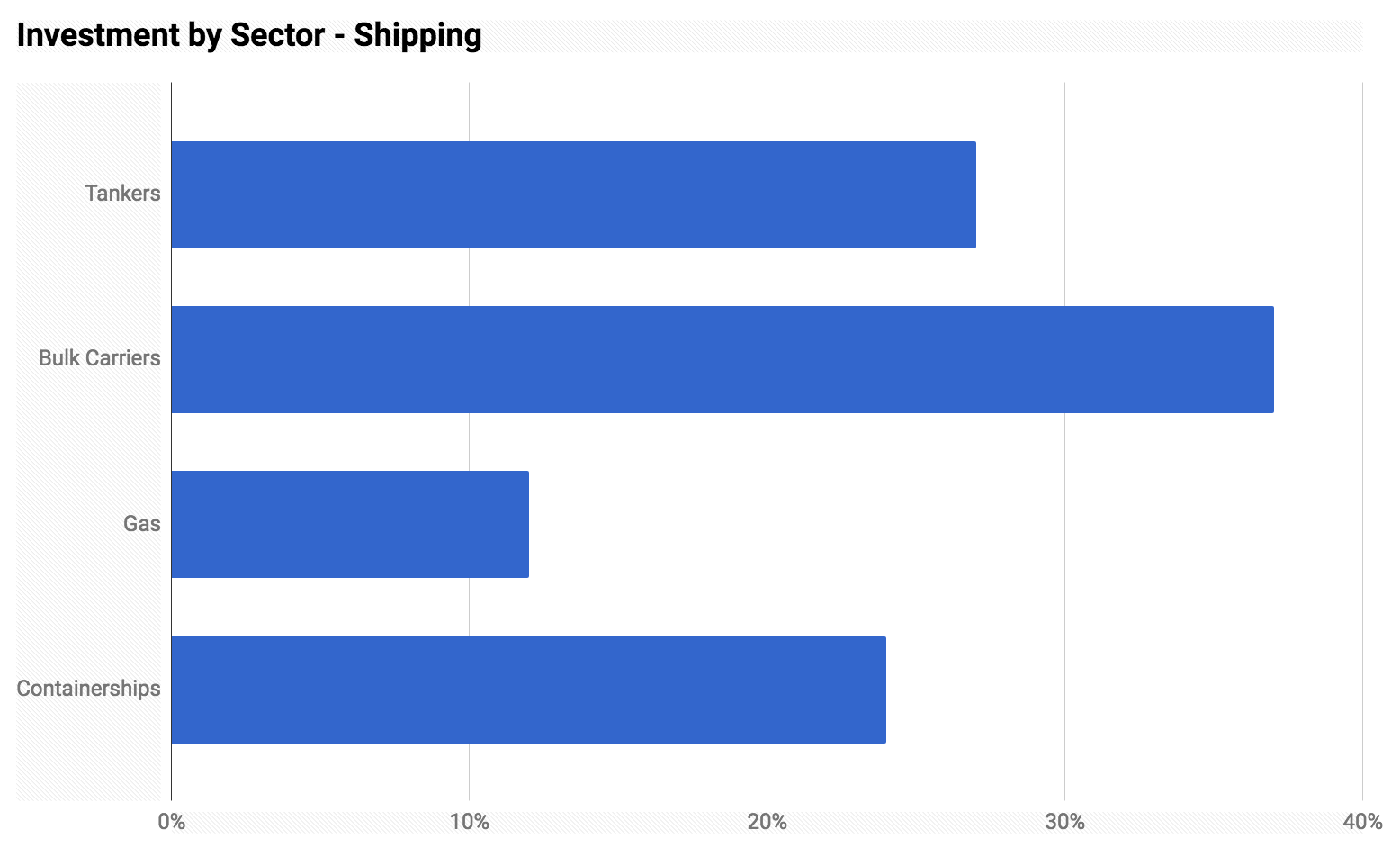

The next chart is based on data from the same report. This time it shows the distribution of investment capital in the freight shipping market. It is pretty self explanatory; Tankers account for 27%, bulk carriers 37%, gas 12%, and containerships 24%.

Additionally, Europe accounts for 36% of gross tonnage in the shipping market and 40% of global investment capital into shipping.

This data appears to confirm a comment we heard from several founders building software for the bulk shipping segment; I am paraphrasing – Investors and the public seem to only be interested in containerships but the bulk shipping market is a significantly bigger portion of the market. ((For the purposes of this post it does not make much sense to segment the bulk shipping market more finely, but it is worth noting that liquid bulk and dry bulk differ in some important ways.))

However, the authors of The Tramp Shipping Market point out that in terms of value of goods transported containerships account for nearly 50% of the market. There is no contradiction; bulk ships mostly carry raw commodities that are required inputs for finished goods that consumers and businesses then buy at a significant markup to the total cost of all the input goods, materials, and labor. It makes sense that people know more about the ships that bring their smartphones, sneakers, jeans, and coffee than they do about the ships that transport the cobalt that is in their smartphones and the raw cotton that is used to make their jeans.

What are the biggest opportunities for startups?

This is an interesting question because the answer depends quite a bit on the perspective of the person answering the question. I attended the Connecticut Maritime Association’s Shipping 2017 in Stamford, CT and I was surprised by the number of software vendors offering products for gathering, analyzing, and interpreting data. It makes sense that there’s a large appetite for data; shiping is a complex process that functions effectively based on coordination between many different parties.

Among the startups John and I studied between September 2016 and February 2017 while we were learning about the shipping industry we observed the following themes;

- Many startups are building platforms to connect people who need shipping services with parties that can provide the service, or to enable various counterparties in the industry to collaborate with one another on some issue. So far many of those have operated in the containership segment of the market. However, a couple have started to build platforms, often marketplaces, specifically for the bulk shipping market. Shipamax and VesselBot are two examples of startups that are building specifically for the bulk shipping market. ((This is not necessarily a completely new business model in the shipping industry since shipping portals like INNTRA, CargoSmart, and GT Nexus have existed for more than a decade.))

- Other startups are building software platforms for gathering, analyzing, and interpreting data for the shipping industry and industries that depend on data related to shipping. Startups in this category which sell primarily to ship operators generally build products that bundle a hardware device with software – no different from the sorts of products that vendors at the CMA’s Shipping2017 Conference were publicizing. In fact a couple of the vendors at the conference were hyping new cloud-enabled versions of their products. I left the conference with concerns about how a startup would differentiate itself from these incumbents. In my opinion Windward seems to be the startup best placed to displace existing incumbents, however it does not appear that Windward is focused on bulk shipping only. Nautilus Labs solves the same problem problem, but is much younger than Windward. ((Nautilus and Windward do quite different things, but both fall within this broad category.))

- One product that it appears the industry would gravitate towards is a system of record that connects all participants in the supply-chain, from end-to-end. This would be a platform into which various shipping industry data could be input, and other data can be obtained as outputs . . . Probably most input data would come from other platforms and data repositories, while output data would be fed to different counterparties based on their access rights and information requirements. It seems to me to be a problem suited for a cryptographically-secure, lightweight, multi-tenant, cloud-based ledger or database of some sort that can also provide anonymity for market participants who wish to maintain some level of secrecy from other counterparties with whom they interact through the platform. One can imagine that governments around the world, for example, would want special access rights in order to keep tabs on the movement of goods and people from one place to another. ((Another example, a company like Cargill might want to protect data about how much of a given commodity it is buying from its competitors although it might be willing to provide its own data as an input in exchange an output sith summary statistics related to its industry and the markets in which it does business.))

You can find other ideas about what the future of shipping might look like here; Cargo Drones and Data Swarms: Experts Weigh In on Digital Transformation in Shipping & Maritime, which was published in KNect365 Maritime in March 2017.

What threats does a technology startup face in selling its products to customers in the bulk shipping industry?

While we were studying the freight trucking market and startups building software for that market we came across Debra T. Johnson’s concept of “invisible barriers to innovation” . . . It appears to me that the issues she described might be even more acute in the shipping industry. There are sales barriers, product barriers, and customer barriers which make it considerably more difficult for startups to gain traction in the shipping market than in other markets that startups typically pursue. For this reason one of the things I look for on a team of startup founders building products for so-called legacy industries is that at least one member of the team has deep industry expertise and has a network that will make it considerably less difficult to overcome the invisible barriers that the startup might face as it attempts to find product-market-fit.

Another issue that makes shipping in general different from other industries with which startup founders might be more familiar – in the shipping industry the unit of competition is the individual ship . . . We discussed this in our original post on shipping. Each ship is operated as if it were an independent organization onto itself – which is true in many respects. I do not know how this affects which sales strategies are most effective for vendors selling tech products to shipping companies. I’m working on figuring that out, but one thing I can say is that the startups that can solve that puzzle comprehensively have a better chance of winning market-share over their peers who do not have an understanding of that phenomenon.

But, all is not lost. There is hope; Demographics.

Shipping is one of the handful of industries globally that approaches the theoretical model of perfect competition that students of microeconomics study in college. That means that profits margins are consistently being squeezed, that the threat of new entrants is consistently high, and that intra-industry competition is acute. However, a new generation of executives is entering the industry. These executives are tech savvy and have gained experience in other industries and now want to try new approaches to running shipping companies in ways that they expect will increase their market-share and improve their profit margins.

I will describe one example.

Mark Hassell and I were colleagues at UBS in Stamford, CT for a short while. He spent slightly more than a decade at UBS Investment Bank where he traded exotic derivative products. After leaving UBS he spent some time working at a couple of startups in San Francisco.

Mark’s family has been in the shipping business in Barbados for several generations. Eric Hassell & Son Ltd. is a family-owned group of companies all focused on shipping and logistics with clients that represent containerships, bulk shippers, NVOCCs, research vessels, specialist shippers, and cruise ships. Mark decided to head back to Barbados in early 2016 after he learned of all the opportunities his cousin, who is presently CEO of the company, felt Eric Hassell & Son Ltd could pursue if she had some more help at the executive management level within the company.

Mark now runs strategy, business development, and corporate development at Eric Hassell & Son Ltd. When we spoke about the shipping industry in March, about a month after we published our article, he said the company had grown revenues by about 20% in 2016 – a significant jump over their performance in 2015. He feels they can repeat, or perhaps improve on that performance in 2017. He is eagerly searching for solutions that will enable EHS to reduce operating costs and grow market-share and revenues at a double digit rate for the foreseeable future.

Business is fascinating right now. The local Barbados economy is on its last legs before some IMF-style austerity measures get implemented so I’m in the process right now of thinking about diversification, while still protecting our core business from increasing competition. I’ve been traveling quite a bit regionally – a lot of fact finding and conferences. I’m finding much more insights in face-to-face conversations than via reports and emails.

– Mark Hassell, via email, June 19, 2017 ((Mark’s comment drives home the fact that the shipping industry’s economic fortunes are very much tied to global business and economic cycles.))

In shipping, and also in trucking – and I have observed the phenomenon in construction too, there’s a generational change taking place. Younger family members like Mark are taking over executive management responsibilities from an older, less tech savvy generation. This new cohort of executives have seen the competitive edge that technology can confer on companies that have ambitions of breaking into the upper echelons of their industry, AND, they have the skill and know-how to deploy technology effectively . . . If I were a startup founder, these are the executives I would be approaching and building relationships with from the outset. Often, these executives do not yet run the businesses that their families own, but they play influential roles in determining what path those businesses will follow in the future . . . and it is often a technology-enabled path.

Lest you think the phenomenon I have described above is restricted only to family-owned companies, INNTRA is undergoing a similar shift in management as well as strategy – according to Greg White, INNTRA’s global head of strategy and business development. What does INNTRA do? INNTRA describes itself as the largest neutral electronic transaction platform and, software and information provider at the center of the ocean shipping industry. It began life as a division within A.P. Moller-Maersk Group, the largest ship operator in the world.

To close this update, I will end with some issues that John and I have encountered as we have spoken with startup founders and shipping industry insiders about the industry; ((We would love to speak with you if you have a perspective on any one of these issues as it relates specifically to shipping. They are issues we expect to be thinking about for a long time.))

- Can technology completely replace human intervention in shipping, can a technology platform solve the trust issue in shipping? ((Complaints that brokers add no value are common.))

- Jenna Brown at Shipamax, Mark Halsell, and Constantine Komodromos at VesselBot think the answer is “no”. They argue that rather than being eliminated completely, as software platforms become more reliable and sophisticated, human intervention will shift from routine but time-consuming tasks to complex issues that require more nuanced judgement and to which there is no straight-forward answer because of the associated trade-offs that have to be made. ((This debate is one that is ongoing in the trucking market too. There are many startup founders who say they expect to cut brokers out of the picture altogether. I think the reality is more likely to resemble what Mark, Jenna, and Constantine predict.))

- This is one of those industries in which relationships matter, and so in order to gain early traction and achieve product-market-fit startup founding teams need to;

- Know the industry and its segments,

- Be known to, and gain the trust of industry insiders, and

- Understand the nuances of the industry’s relationship to technology and software.

- Efficient scale could be a challenge for startups selling products to customers in the ocean shipping industry. Investors should invest time understanding how startup founders intend to overcome that obstacle, if it exists.

- Maritime law is complicated, and can be opaque for people who are unfamiliar with its peculiarities. This is a point that was raised as a concern by Michael Rainsford, a former derivatives trader at Morgan Stanley who now advises a number of startups in shipping, trucking, and derivatives. It is unclear how the peculiarities of maritime law will affect software startups that do business with ocean shipping companies.

- Fuel efficiency is a big problem for the global shipping industry, but not enough people are talking about it. This is a point of view expressed by Ted Shergalis – a co-founder, and the chief operations officer at Magnuss. Magnuss adapts wind-powered propulsion technology whose underlying principles were first discovered by the German physicist, Gustav Magnus in 1853. Magnuss marries its hardware with software to generate fuel savings of up to 50% – according to the founders. This is a big deal in the bulk shipping market since fuel costs represent 60% – 70% of operating costs – according to Magnuss founders. ((I have not been able to find data on operating expenses in the shipping industry comparable to what I found for the trucking industry.))

- Coincidentally, a few days after my conversation with Ted, Maersk, Norsepower, and Energy Technologies Institute (ETI) announced that they would be trialing a version of the technology that Magnuss is building.

- A version of the hardware component of this system was tested by the German engineer, Anton Flettner, in the early 1920’s but failed to gain commercial traction because of the economic conditions at the time.

- One gets a sense that this will become more pressing an issue for the industry on the basis of this announcement from the International Maritime Organization’s Marine Environment Protection Committee’s 70th Session which was held from 24 – 28 October 2016. Basically, there are new regulations to reduce Nitrogen Oxides, Sulphur Oxides, and Carbon Dioxide emissions by the industry starting as early as 2020.

- One danger that startups building technology for the shipping industry can encounter is the problem of investors who do not understand the nuances of the shipping industry, and so might try to persuade early-stage startup founders to adopt strategies and tactics that the venture capitalists have seen work in markets that are more traditional hunting grounds for early-stage investors. These strategies may very well work when the startup is much more mature, but they can backfire if they are adopted too early. This is an observation that was expressed by Bill Dobie, a technologist who has been building software for the shipping industry since 2000. John and I heard comments along a similar vein when we studied startups building software for the trucking industry.

- I expect that we will see more specialized accelerators like Port XL emerge to support founders building startups that are regionally-focused – say, for example, a competitor to Flexport that is primarily focused on serving a customer base in Asia, the Middle East, Australia and New Zealand.

With an estimated $4.5 trillion-plus in capital required to finance transportation assets over the next 10 years, this is a large-scale and wide-ranging investment opportunity.

– Anton Pil, Managing Partner, JP Morgan Asset Management. ((See; JP Morgan Asset Management secures $480m for new shipping fund, Sam Chambers, Splash 24/7. Accessed on June 20, 2017.))

Ocean shipping is an enormous industry . . . By one guess the opportunities in the industry are large enough to support 10 billion-dollar-plus startups. I’m assuming that Flexport has one of those spots firmly in its grip. Perhaps Windward has a strong claim to another. That leaves 8 or 9 opportunities to create a billion-dollar-plus startup focused on ocean shipping.

We are eager to find and invest in as many of them as possible. We’d love to talk to you if you are based in North America and believe you are working on an idea that has the potential to transform the shipping industry to enable it to meet the challenges our world will encounter over the next 50 – 100 years. Even if you are not based in North America, but happen to visit New York sometime in the future we’d be happy to meet for coffee and hear about your experience, if you have some free time and want to chat.

You can reach us at;

- brian@kecventures.com (@brianlaungaoaeh),

- johna@kecventures.com (@jnazubuike), and

- dylan@kecventures.com (@dreidco).

Update: June 20, 2017 at 17:13 to change “Vesselbot” to “VesselBot” based on email from Constantine.

Update: June 20, 2017 at 17:30 to include quote from article about JP Morgan Asset Management’s new shipping fund.

Update: June 20, 2017 at 17:50 based on call with Jenna Brown at Shipamax.

Update: June 20, 2017 at 18:20 based on email from Jenna Brown re: marketplaces vs. platforms and Windward vs. Nautilus. Added footnotes.

Update: June 21, 2017 at 09:45 based on corrections from John Azubuike.

Update: June 21, 2017 at 12:15 to include link to MEPC70 announcement about IMO regs on low SOx, NOx, and CO2 emissions.

Update: June 22, 2017 at 09:20 based on June 21, 2017 email from Mark Hassell re: EHS corrections.